Since these forms are virtually identical in function, the main reason to use Form 1040-SR is if you're filling out your tax return by hand rather than online. For example, you are not forced to take the standard deduction if you choose to file with Form 1040-SR. There aren't any other caveats that come with using this form.

Who can file using Form 1040-SR?Īnyone age 65 or older can opt to use Form 1040-SR instead of Form 1040.

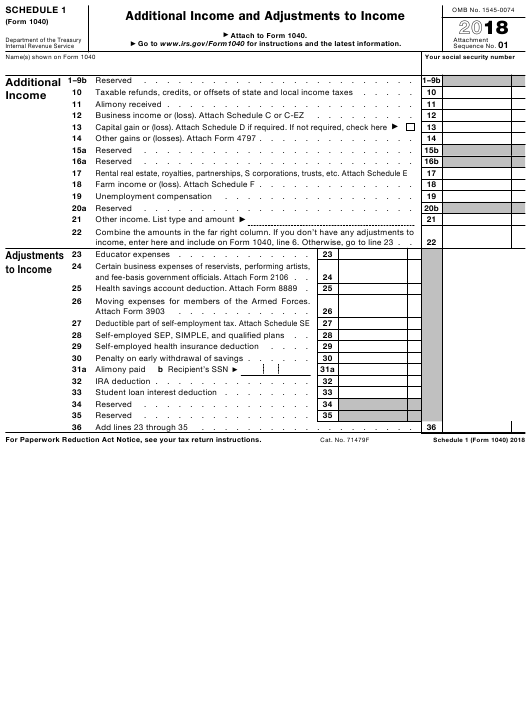

Form 1040-SR uses the same line items and instructions as the standard Form 1040. The idea was to make it easier for seniors with simple tax situations to file their tax returns.Īs a result, the IRS created a version of Form 1040 that uses larger print and includes a standard deduction table directly on the for so that seniors can quickly look up their standard deduction amounts.

0 kommentar(er)

0 kommentar(er)